YOU DESERVE A BREAK TODAY

When a new year rolls around, the minimum wage rises in cities and states across the country. And when the minimum wage rises, there’s sure to be some jokers setting out to see who can make the most ridiculous claim about how giving modest raises to poverty-wage workers will supposedly have devastating economic consequences.

This year’s achievement in minimum wage concern trolling goes to the executive vice president of the National Taxpayers Union, who went on Fox News last week to claim that a new $20 minimum wage for California fast food workers was “unfair” because of the impact on customers, who he says will be “all of the sudden paying $12, $15 for a Big Mac.” In fact, the average Big Mac in California currently costs $5.89, so this guy is effectively arguing — on national TV — that increasing the minimum wage a few dollars an hour will somehow make the price of a burger more than double… and that this impossible, made-up result is “unfair.” He went on to also predict — also with no basis whatsoever — that raising wages would cause as much as a “12, 15% reduction” in fast food jobs. So apparently the whole thing here is that the guy gets a headline where he’s called an “analyst” because he just really likes to repeat the numbers 12 and 15?

Make it make sense.

is now the cost of an insulin prescription for millions more people in the US. The sharp price reduction comes as the result of public pressure and some smart policy changes that were part of President Biden’s American Rescue Plan.

is spent by consumer goods companies on third-party audits, which are supposed to ensure compliance with labor laws and other basic standards. However, these private inspections— paid for by the brands whose products they’re inspecting — have repeatedly failed to identify child labor violations.

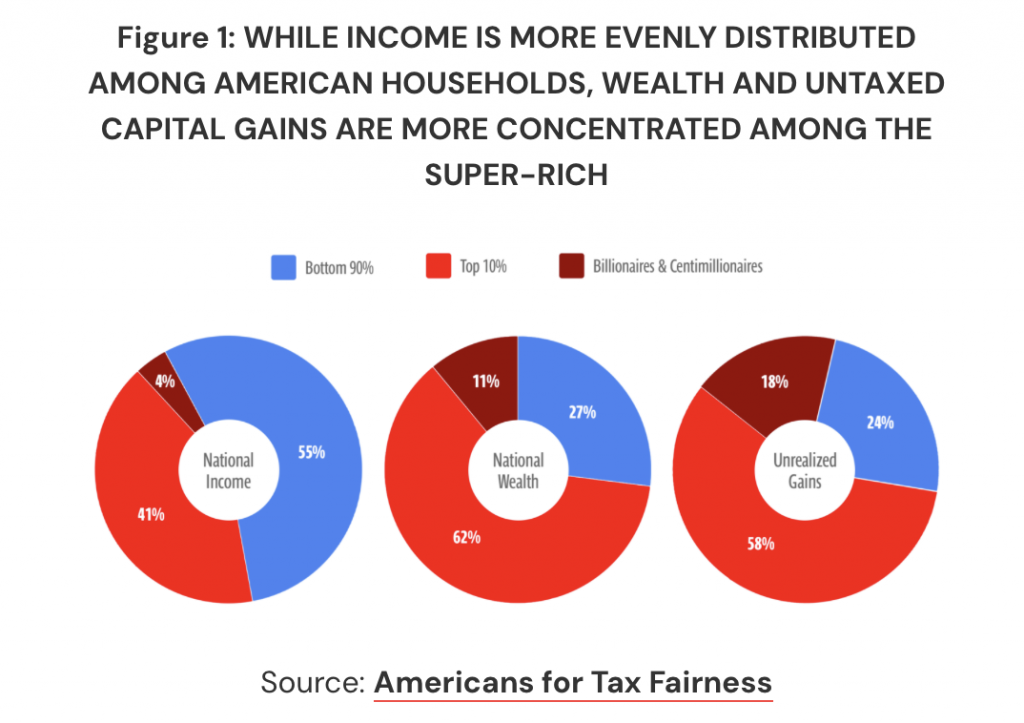

of the benefits of the Trump tax law went to the 10% richest people in the country. This extreme trickle-down result was an intended consequence of how the bill was designed.

One of the ways our federal tax system works is that when the value of an asset such as a stock, bond, or other financial investment goes up, you generally don’t have to pay taxes on that increase in value until it’s “realized” — that is, until the asset is sold. At that point, you generally have to pay capital gains tax on your profit.

The problem is that much of the increased value of assets owned by the ultra-wealthy is never realized, so they never pay taxes on the assets. Here’s the trick: when the owner of a valuable asset is alive, they can take out low-interest loans against that increased value and enjoy the benefits of their increased wealth without having to cash out and pay taxes on the gain. And when they die, they get to pass on these assets to heirs without anyone involved ever paying any tax on the gains. This is called the stepped-up basis loophole, and it’s quite generous and massively unequal: as the chart below shows, fully 18% of all unrealized and untaxed capital gains — a staggering $8.5 trillion — are held by just 64,000 ultra-wealthy households.

There’s so much hype around AI lately that even the concerns that get aired seem to function as part of the same promotional scheme, just echoing the vast power and inevitable transformation AI will bring. So it’s welcome to see Silicon Valley Congressman Ro Khanna grapple with AI in a vastly different context — and one that’s vastly more valuable.

In a recent piece in the NY Times, Khanna draws a compelling parallel between the conversation about AI and the conversation about globalization in the early days of NAFTA and the WTO. Back then, because mainstream economic models indicated that free trade would benefit people overall, many dismissed the specific impacts of globalization on working-class communities, and the political class failed to do anything about it… with political implications that continue to echo today. We’re now at a similar moment with AI, Khanna argues: generative AI may very well bring aggregate economic benefits, but those benefits won’t be equally distributed, and in fact, many people and communities could very well lose out in the transition… unless we actually doing something about these impacts this time around. As he puts it: “Our generational task is to ensure that A.I. is a tool for lessening the vast disparities of wealth and opportunity that plague us, not exacerbating them.”

What did you think? Choose a reaction:

Civic Action

119 1st Avenue South Suite 320

Seattle, WA 98014

United States